does owing the irs affect buying a house

Compare More Than Just Rates. How does owing the IRS affect buying a house.

The Top 10 Consequences Of Tax Debt H R Block

You must owe more than 5000 in back taxes.

:max_bytes(150000):strip_icc()/mortgage-preapproval-4776405_final2-f5fbd4d3d08d4aeeb04cc12fc718ae00.png)

. Tax liens debt servicing and lack of security are all ways owing the IRS affects buying a house. If you have unpaid taxes the IRS can put a lien against your property or other. The gain from your home can be tax-free up to.

Ad 4 Simple Steps to Settle Your Debt. Well discuss each point more in-depth below. When tax liens are involved it can make the process a stressful one.

Compare Rates Get Your Quote Online Now. We have decades of. Ad Need Help Calculating Your Mortgage Payment.

Find A Lender That Offers Great Service. Owing taxes or having a tax lien does make it harder. If the IRS has filed a Tax Lien against you in the county where the subject property is located you WILL need to pay off the entire Federal Tax Debt and have the lien released.

Before the IRS can seize your home using a tax levy the following requirements must be met. Although you can technically buy a home if you owe money to the IRS you may have trouble selling the home you already have. In a Nutshell Yes you might be able to get a home loan even if you owe taxes.

A tax debt doesnt equal a blanket rejection for a mortgage application. When you owe back taxes the IRS has broad authority to collect. Mortgage lenders realize the risks that come with owing the IRS money and what measures this federal agency can use to recoup outstanding tax balances.

Thankfully compared to a decade ago there are fewer IRS liens out there today due to changes to our tax laws. They do not want to loan money to. The short answer is that owing the IRS money wont automatically prevent you from qualifying for a home loan.

If you have an IRS lien on your income or assets it will greatly diminish your chances at getting approved for a mortgage. Potential home buyers who owe taxes to the IRS may find it difficult to obtain financing from a mortgage lender. A smaller monthly payment will impact your debt-to-income DTI ratio the least.

Try Our Free Tool Today. Ad Americas 1 Online Lender. If the debt-to-income ratio is drastically affected by an IRS.

If youre not ready to give up on the house of your dreams call SH. I would suggest that you contact a competent tax attorney or contact the IRS directly to consider your options. They can issue a tax lien against your property in order to satisfy this debt and so mortgage lenders may be hesitant to approve.

How far back do mortgage lenders look at taxes. Owing the IRS can lead to a tax lien Owing. If your DTI is 44 without the IRS monthly payment determine how can pay and still keep your.

The IRS must have a signed. Does owing the IRS affect buying a house. To help calculate your income.

What Is A Prepayment Penalty And How Can It Affect You Irs Debt Payoff Irs Taxes

Do You Need To File A Tax Return In 2022 Forbes Advisor

What Is Taxable Income And How To Calculate It Forbes Advisor

:max_bytes(150000):strip_icc()/mortgage-preapproval-4776405_final2-f5fbd4d3d08d4aeeb04cc12fc718ae00.png)

How To Get Pre Approved For A Mortgage

Annuity Taxation How Various Annuities Are Taxed

Amending Your Taxes Be Careful With Irs

Annuity Taxation How Various Annuities Are Taxed

Get A Tax Credit For Buying A House Credit Com

Understanding Your Foreclosure Rights Credit Com

How To Get Rid Of Your Back Taxes Nerdwallet

How Does Co Signing A Mortgage Impact Your Personal Taxes

How Do Tax Liens Work In Canada Consolidated Credit Canada

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

Can I Buy A Car After Bankruptcy

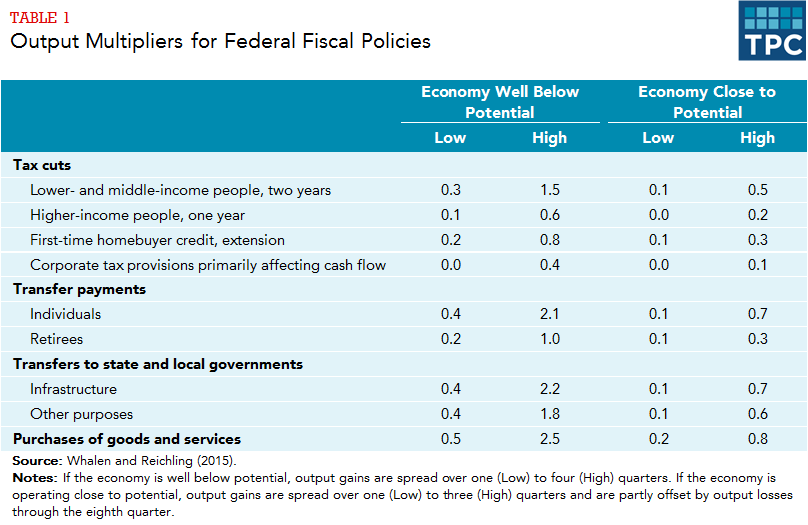

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Buying A Second Home Tax Tips For Homeowners Turbotax Tax Tips Videos

Deducting Home Loan Interest Is Trickier Under New Tax Rules Cbs News

What Is A Tax Lien And How Does It Affect Your Financing Options

Video Does Owing The Irs Affect Your Credit Score Turbotax Tax Tips Videos